Safaricom and Pezesha Introduce ‘Mkopo Wa Pochi’ to Lend Small Businesses

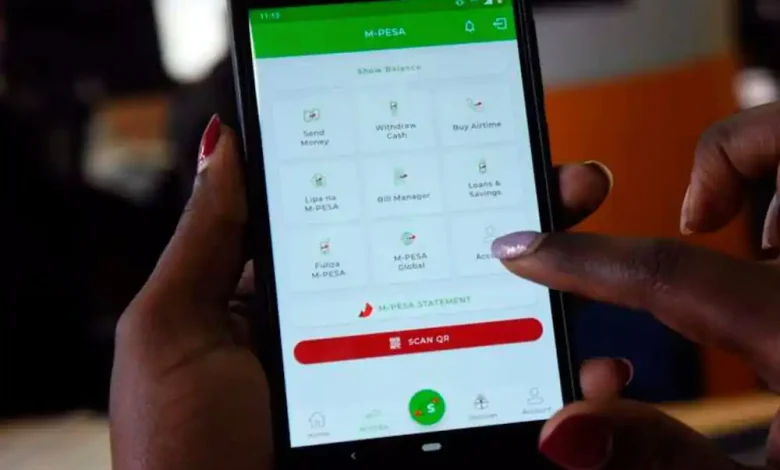

More than 600,000 users of the ‘Pochi La Biashara’ payment service can now borrow small loans with a one-time access fee of 2.76% on the principal amount, courtesy of a deal signed between Safaricom and the fintech company, Pezesha.

The new loan service targets informal business owners who cannot access loans from banks and micro-finance institutions due to lacking collateral. The users can borrow money directly through their M-Pesa business accounts, a feature that enables business owners to properly distinguish between money meant for business and for personal use. Pezesha’s credit management experience will be instrumental in determining borrowers’ credit history, working with credit bureaus to ensure defaulters are listed and denied future loans. “Loans advanced shall be subject to a tenor of seven days and a maximum rollover period of fourteen days, during which a roll over fee equivalent to 3.85% for the fourteen days shall be charged. You may only roll over the loan once,” Safaricom says in its terms and conditions.

Customers can pay in instalments or full lump sum before the specified date for repayment of the loan. Pochi La Biashara users are also reminded that in the event that the loan remains unpaid by the due date, deductions will be automatically made from the wallet.

In May this year, Pezesha received US$ 500,000 from the Development Finance Corporation to improve its credit-scoring technology. This partnership will consolidate the company’s presence in the credit management market, having supported more than 50,000 MSMEs so far.

Safaricom’s ‘Mkopo Wa Pochi’ is an additional credit facility after M-Shwari and Fuliza, both of which have been crucial in providing emergency short loans to its customers. Their success in this enterprise has brought numerous loaning apps into the market; banks have even rolled out apps that allow their customers to borrow short-term loans.

Many small business owners have no need for large amounts of capital that they would have difficulty repaying. Most of them prefer short loans that are easily repayable and are convenient for stocking up their enterprises within the shortest time possible. The advancement of technology and the increased mobile phone penetration has also made these loans lucrative and accessible.

However, defaulting these loans has been a headache for its providers since 2020. Many customers have also perceived short loan apps and services as ‘stressful inconveniences’ they could do without, thus opting out. But short loan platforms have insisted that their services are helpful when used for business purposes and not just personal household needs.

See Also:

Safaricom Ethiopia Receives Locally-Made Towers ahead of US$ 1.5 Billion Investment

ADVERTISEMENT