Understanding Pay as You Earn (PAYE) Tax

1. What is PAYE?PAYE stands for Pay As You Earn, a taxation system in Kenya where employers deduct income tax from their employees’ earnings and remit it to the Kenya Revenue Authority (KRA).

2. Taxable Employment IncomeEmployment income subject to taxation includes all forms of cash payments and non-cash benefits exceeding Ksh 3,000 per month. Cash pay encompasses wages, salary, sick pay, leave pay, fees, commissions, bonuses, and more.

3. PAYE Registration EligibilityAny entity paying emoluments to employees is required to register for PAYE. Upon registration, they must deduct tax from employees’ earnings and remit it to KRA.

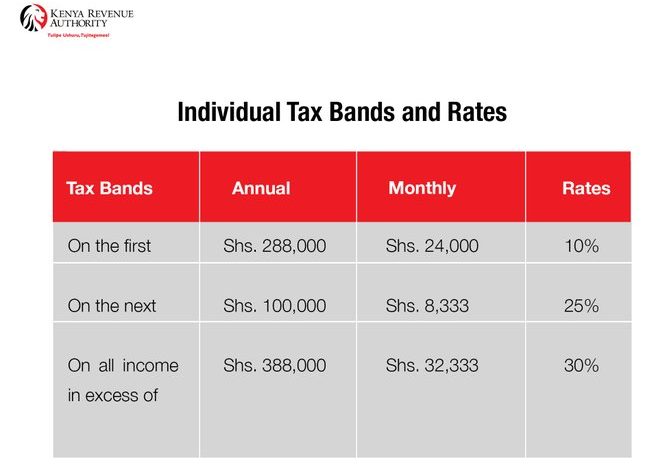

4. Income Tax Individual Tax RatesEmployers use individual income tax rates ranging from 10% to 35% to compute PAYE, as per the Finance Act 2023. These rates apply to different income bands and are effective from July 1, 2023.

5. Personal Tax ReliefResidents are entitled to personal relief, currently set at Kshs 2,400 annually, aimed at reducing their tax burden.

6. Pay As You Earn Due DateEmployers must deduct PAYE from employees’ earnings and remit it to KRA by the 9th day of the following month.

7. Non-Cash Benefits Chargeable to TaxCertain non-cash benefits provided to employees, such as motor vehicles, housing, and loans at below-market rates, may also be subject to taxation.

Gains or profits from employment that are not paid in cash are chargeable to tax. Such gains or benefits include:

Where an employee is provided with a motor vehicle by his employer a car benefitProvision of housing by the employerLoans at interest rates that are lower than the prevailing market rateHousehold utilities – including telephone, electricity, water, security, domestic expenses above the allowable limit of Kshs 3,000 perPension contribution paid by a tax-exempt employer to an unregisteredPension contribution paid by an employer to a registered or unregistered scheme above the allowable amount of Kshs 20,000 or Kshs 240,000 per annumDisclaimer: This guide is for information purposes only. For accurate and up to date tax policies and procedures, please refer to the KRA website or your tax consultant.

8. Allowable DeductionsEmployees can make deductions from their earnings, including mortgage interest and pension contributions, to arrive at the taxable amount.

These deductions are amounts subtracted from an employee’s earnings to calculate taxable income.

Mortgage Interest Deduction: This involves the interest paid on loans acquired from the first five financial institutions specified in the fourth Schedule of the Income Tax Act. These loans must be used for purchasing or improving residential premises occupied by the individual during the income year. The deduction applies to employment income and is limited to a maximum of Kshs 300,000 per annum.Pension Contributions: Employees’ contributions to a registered pension fund qualify for deduction. However, the allowable deduction is capped at a maximum of Ksh 20,000 per month.9. Tax ReliefsTax reliefs, such as relief on post-retirement medical fund contributions and insurance relief, aim to lessen the tax burden on employees.

Post-retirement medical fund contributions now benefit from tax relief, as per the Finance Act of 2023. This relief allows for a deduction of 15% of the contribution amount or KES 60,000 annually, whichever is higher, effective from January 1, 2024.

Insurance relief is granted to employees who have paid insurance premiums for life, health, or education policies for themselves, their spouses, or children.

This relief amounts to 15% of the premiums paid, up to a maximum of Kshs 60,000 per year. Policies related to education and health must have a maturity period of at least 10 years. Additionally, contributions to the National Hospital Insurance Fund (NHIF) qualify for insurance relief starting from January 1, 2022.

Under the Employment Act of 2007, both employees and employers are required to contribute to the Affordable Housing Levy. This levy is set at a rate of 1.5% of the employee’s gross monthly salary. The contribution must be remitted within 9 working days after the end of the month in which the payment is due.

10. PAYE Return FilingEmployers compile a list of employees from whom they deducted tax and submit this information to KRA via iTax. Returns are submitted online, and penalties apply for non-compliance.

11. PAYE Payment ProcedurePayments can be made through various channels, including iTax, banking institutions, M-PESA, or debit/credit cards. A step-by-step process is outlined for ease of payment.

Here’s a step-by-step guide for employers to file their PAYE returns and make payments:Compilation of Employee List: At the end of each month, the employer needs to compile a list of employees from whom tax has been deducted.Submission of PAYE Returns: PAYE returns are submitted online through iTax. If there are no taxes to declare, a nil return must still be submitted.Filing Process:Log in to iTax using your KRA PIN and password.Navigate to the “Returns” tab and select the “File Return” option.Choose the tax obligation as “Income Tax – PAYE” and download the Excel return form.Fill in the form accurately and validate it.The system will generate a zipped file, which should be uploaded under the “File Return” section.

Agree to the Terms and Conditions and submit the return. After successful filing, an acknowledgment receipt will be provided to confirm the submission.

PAYE Payment Procedure:Login to iTax via https://itax.kra.go.ke.Click on the “Payments” tab and select “Payment”.Choose “Income Tax” as the tax head and “Income Tax” as the tax subhead.Select “Self-Assessment” as the payment type and specify the tax period.Add the liability and select the mode of payment as “Other Payment Mode” or “RGTS”.Click on “Submit”Payment Methods:Payments can be made through the bank using the generated payment slip.

For M-PESA payments, use the Paybill number 572572 and enter the account number as the Payment Registration Number. Follow the prompts to complete the payment.

Debit/Credit Card payments can be made by filling in the required details.Upon completion, a copy of the payment slip will be sent to the taxpayer’s registered email address.

12. PenaltiesPenalties apply for late filing, late payment, or failure to deduct and account for tax, emphasizing the importance of adhering to PAYE regulations.

The deadline for filing a PAYE return and making tax payments is the 9th of the following month. Failure to meet this deadline will result in penalties as follows:

i) Late Filing:

The penalty is the higher of 25% of the tax due or Ksh 10,000.ii) Late Payment:

A penalty of 5% of the tax due is imposed.Additionally, late payment interest of 1% per month or part of a month is charged on the unpaid tax until it is settled.iii) Penalty for Failure to Deduct and Account for Tax:

This penalty amounts to 25% of the Tax Involved or Kshs. 10,000.00, whichever is higher.Employers must adhere to these deadlines to avoid incurring these penalties

Disclaimer: This guide is for information purposes only. For accurate and up-to-date tax policies and procedures, please refer to the KRA website or your tax consultant.